The Keys to Doubling Your Business are Right in Front of You

by Craig Rosenthal

May 12, 2020

Did you know it can cost five times more to attract a new client than it does to retain an existing one?[1] Many believe that the key to business growth is new sales. However, don’t miss out on your biggest opportunity to grow by building on the relationships with your existing clients.

Keeping Happy Clients

The top two reasons plan sponsors hire advisors are to help with understanding how well the plan is working for employees and how to improve it.[2] They want to know that their retirement plan is working to financially prepare participants for retirement.[3]

To illustrate plan performance metrics, advisors could track financial preparedness, provide ideas to enhance contribution rates, and host regular retirement plan committee meetings. They are all great ways to deliver immense value, demonstrate your involvement and expertise that will ultimately increase participant outcomes. However, you don’t want to conduct a meeting just for the sake of meeting. To ensure efficiency, provide an agenda and supporting reports prior to the meeting.

To help you host topical retirement plan committee meetings, download this complementary agenda template to highlight key plan metrics and have better conversations.

Meeting discussion points can include:

- Retirement Plan Overview

- Investment Policy Statement

- Investment Monitoring

- Asset Allocation

- Benchmarking

- Plan Assets

- Participation Rate

- Compliance

- Plan Design Education

- Census

- RMDs

- Loans

- Testing

- 5500 Reports

- Audit

- Employee Education

- Employee Engagement

- Financial Wellness

- Cost Summary

- Regulatory Updates

In addition to regular committee meetings, you need to consistently stay in front of your clients. For more ideas to stay top of mind, read our previous article: Your Clients are my Prospects.

Client Referrals

There is no doubt that our business thrives on referrals and the best way to gain them is through happy clients! Below are a few ideas on ways to increase client referrals:

- Ask at the right time. Consider when they are most satisfied with your services (possibly after demonstrating value at a quarterly meeting)

- Host a client appreciation event. This is a great way to interact outside of the plan

- Be searchable. Make sure you have a good digital presence, most folks will google you prior to calling, so be sure you look the part online.

Plan Design Updates

With the passing of the SECURE Act, there are new opportunities to increase the assets in the plan which could have a direct impact on your revenue.

For example, under the SECURE Act, the Safe Harbor deferral cap for auto-enrollment has increased from 10% to 15% of salary. This auto-enrollment nudge could create an opportunity to increase plan assets while helping participants better prepare for retirement.

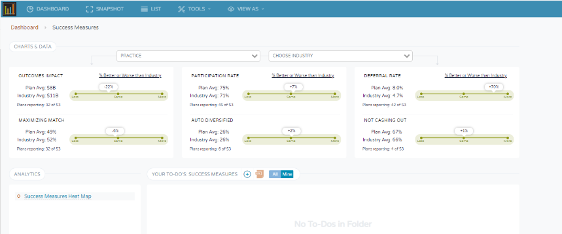

Before you think “my clients will never elect such a high automatic deferral.” Remember, they don’t have to start at 15%, they can work up to it. Take a look at the plan’s current deferral rate. Then use the new Business Management Dashboard success measure benchmarking page to learn industry averages. If the plan is trailing industry benchmarks, then recommend that the plan sponsor implement auto-enrollment at that deferral amount or slightly higher.

Additionally, keep in mind that by stretching the auto-enrollment amount, you are advancing participants towards better savings behavior. For example, if the previous auto-enrollment rate was 10% and the plan’s average deferral was 6% and they increase the auto-enrollment rate to a 15% deferral and the plan’s average deferral increases to 12%, the participants are saving more than previous and that places them on a better track towards retirement success.

Enhancing the amount of savings that goes into the plan should add more assets to the plan and thus more revenue opportunities for the advisor. Increase savings to increase asset based compensation. Or, if advisory compensation is a flat fee, the compensation will usually follow. For example, when the plan assets grow, then the plan will graduate to the next tier of benchmarking. That growth usually corresponds with more responsibility and enhanced flat fee compensation.

3 Strategies for implementation:

Automatic Enrollment

Increase automatic enrollment deferral percentage. The default selection has a huge impact on plan assets and employee savings behavior. This is perfect for new hires, once employees start deferring, over 90% will keep saving at that level.

Automatic Escalation

A standard escalation formula increases deferrals 1% annually up to 10%. The SECURE Act increase allows plan fiduciaries to update the plan design to continue increasing up to 15% deferral.

Re-enrollment

What about tenured employees? A re-enrollment initiative could help existing employees defer at a more impactful rate and reallocate their investments. For more talking points on the benefits of re-enrollment, click here for a helpful white paper from BlackRock.

A Bird in the Hand Is Worth Two in the Bush

While it may be tempting to seek out new clients, remember that your existing clients are the key to building your business. Not only is it an exceptional way to demonstrate your value but it is also a chance to leverage those relationships for more new sales opportunities.

For more ways to gain new sales and grow your business, contact us to learn about the exciting features included within the new Fiduciary Decisions Business Management Dashboard.

[1] Forbes. “Don’t Spend 5 Times More Attracting New Customers, Nurture The Existing Ones.” Sept 2018.

[2] NAPA. “401(k) Sponsors Look to Advisors for Help with Plan Improvements.” August 2019.

[3] Fidelity Investments. “Plan Sponsor Attitudes.” 10th Edition. August 2019.

About Author:

Craig Rosenthal, Head of Strategy and Chief Marketing Officer

Craig is Head of Strategy and Chief Marketing Officer for Fiduciary Decisions. In this role, he is responsible for driving Product and Partnership strategy as well as the overall messaging and marketing for the firm.