How Do You Determine an Accurate Personal Retirement Goal?

by Tom Kmak, Chief Executive Officer

Sep 30, 2023

This article is the first of two articles about “The Magnificent Seven: Key metrics that predict and measure how well a retirement plan is helping participants prepare for retirement”.

Recently, an insurance company survey said the average American believes they need $4.3 million to retire. A survey from a different insurance company stated the number is $1.27 million.

So, which one is right? The answer is…NEITHER.

The problem with both surveys is that they are exactly that—surveys. It isn’t quite the same, but you might as well ask people what the Powerball numbers will be this weekend. As someone who has been in the retirement plan industry for almost 40 years, I find it disheartening that we are still doing surveys that add little value for American workers. In fact, the danger of these surveys is they could stop people from even trying to take action – and I find that even more disheartening.

No wonder many savers adopt an attitude of: “If the goal is so impossible, why try? I will just keep working until I can’t.”

"Without a clear goal, a saver is like the Cheshire cat in Alice in Wonderland, who maintains, ‘If you don’t know where you’re going, any road will get you there.’”

– Tom Kmak

Fortunately, there are key metrics that predict and measure how well a retirement plan is helping its participant prepare for retirement. These metrics fall into four distinct categories:

KNOWING | SAVING | INVESTING | SPENDING

![]()

But the most important metric is to establish a Personal Retirement Goal (PRG)—the amount of savings you need in order to retire at the living standard you want. This is the logical place to start. Otherwise, without a clear goal, a saver is like the Cheshire cat in Alice in Wonderland, who maintains, “If you don’t know where you’re going, any road will get you there.”

Download our supplement for calculating how much money may be needed in retirement.

Establishing a PRG boils down to two simple “wants”

Answers to these two questions take a saver further down the road to understanding their PRG than any general survey:

1. When does the participant want to retire?

2. How much does the participant want in monthly income in retirement?

I believe the reason you have the wildly varying survey estimates, referenced above, is because many retirement plan service providers have not taken the time to help participants define these two “wants.” I’ll provide some important guidance on these two components of a personal retirement goal.

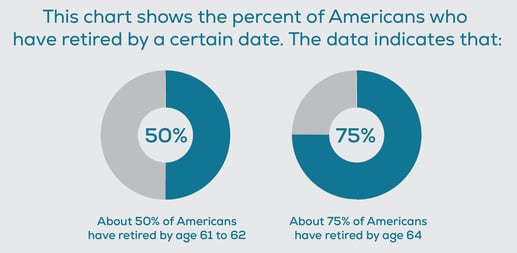

Key planning question #1: When does the participant want to retire?

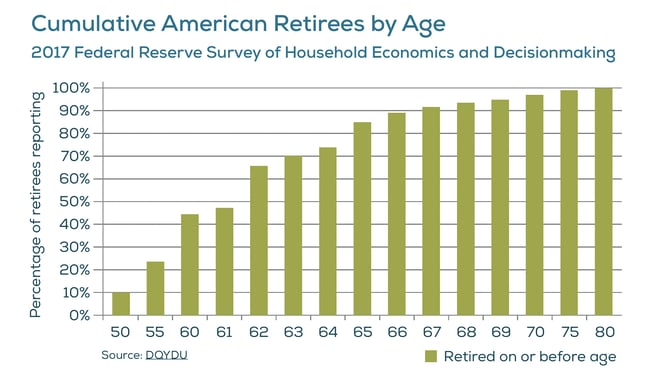

If you conduct sensitivity analysis (a mathematical approach for determining the most impactful item), you will see when you retire is the most critical metric for determining how much money you will need for retirement (this is why Social Security reduces the payout by 30% if you retire at age 62 instead of at age 67). A good personal advice program should solicit this critical answer for each participant.

Key planning retirement question #2: How much does the participant want in monthly retirement income?

While there are several ways to answer this question, most approaches to calculating “how much money do you need to retire” fall into two basic categories:

1. A simple rule such as that it should be 75% of your final pay or ten times your salary at age 65.

2. A more complex method that varies the percentage of your final income inversely with the level of compensation.

So, while #1 is a good start, #2 is a better approach, the BEST answer for anyone is that this answer is always personalized. For example, imagine two individuals who are 62 years old both making $120,000 a year at retirement but with very different life circumstances:

HOUSING

One individual has their house completely paid off while the other has a small mortgage (due to a divorce later in life).TRANSPORTATION

One individual keeps a car until it has 250,000 miles while the other likes to lease a new car every three years.HEALTHCARE

One individual is incredibly healthy while the other is not.ENTERTAINMENT

One individual eats out and travels a lot while the other prefers to stay home and enjoys cooking.

While there are other expenditure differences to examine, these four differing circumstances clearly result in a different answer to the question: How much does the participant want in monthly income?

Finding the answer

How hard is it to get a participant to answer the two questions related to a PRG? Well, probably tougher than we think, although from my experience leading employee enrollment meetings earlier in my career, I have witnessed that people are willing to share important details about their life when they genuinely believe you’re trying to help them.

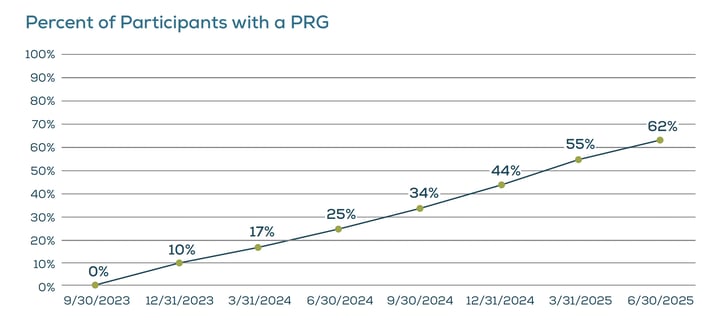

Lastly, consistent with Peter Drucker’s famous saying that “What gets measured gets managed,” it is vital that service providers start measuring what percent of participants have a PRG in a manner similar to the chart below.

Can we reach this milestone right away? No. But having worked with the largest and most prestigious service providers in the retirement industry, I am confident that we—as an industry–have the aptitude and attitude to move the industry forward on this critical metric of “what does retirement savings success look like.” Fiduciary Decisions is ready and willing to assist.

“ I have witnessed that people are willing to share important details about their life when they genuinely believe you’re trying to help them.”– Tom Kmak

We Can Help

Please share this thought leadership piece with plan sponsors, plan advisors and others to encourage them to help retirement plan participants establish their PRG.

About Author:

Tom Kmak, Chief Executive Officer

Tom Kmak is the co-founder and Chief Executive Officer of Fiduciary Decisions (FDI, formerly Fiduciary Benchmarks). During his 16 years with the firm, FDI has become the industry’s leading firm for benchmarking retirement plans using a patented approach that recognizes the mathematical truth that “Fees Without Value is a Meaningless Comparison.” Tom is pleased to say that FDI’s benchmarking service is used by 70% of the largest and most prestigious Recordkeepers as well as over 60% of the best Retirement Plan Advisors as recognized by various industry publications. Tom has also been involved in the development of other services at Fiduciary Decisions, such as the Rollover Decision Support System supporting DOL PTE 2020-02, as well as the interactive plan design tool called the Retirement Outcomes Evaluator.

Prior to founding FDI, in 1990 Tom started the JPMorgan Retirement Plan Services business with American Century. Upon leaving in October 2007, that business employed 1,100 people serving two hundred large plan sponsors with over 1.5 million participants and more than $115 billion in assets. During his career with Retirement Plan Services, the company initiated numerous industry firsts including no blackout conversions and the innovative employee education program, Audience of One. Tom also served on the Executive Committee for JPMorgan’s asset management business.

Tom graduated Phi Beta Kappa from DePauw University with B.A. degrees in Economics and Computational Mathematics. He was the first graduate of the Management Fellows Program and a 3-year letterman in inter-collegiate basketball.