Recalibrating the 401(k) for Inflation

by Craig Rosenthal

Feb 21, 2022

Inflation is in the news for a reason. It has accelerated at its fastest pace in 40 years with a 7% spike in December 2021, and your employer clients may be struggling with the increased costs of supplies. They are feeling the pinch across their bottom lines due to the increased costs of raw materials. Whether it is flour (+7%), sugar (+%5), eggs (+13%), delivery (+7%), vehicles (+12%), or gasoline (+49%), inflation is creeping into every corner of their business.[1]

As such, employers have two choices, they can either let inflation chip away at their profits or pass along the increase to their consumers. Diligent and smart employers are figuring out ways to increase prices or adjust their products and services to remain in business – and that includes employee benefits.

Optimizing Benefits in a Tight Market

It’s a precarious time for employers. With labor shortages caused by “The Great Resignation” and the unemployment rate at 3.9%, it can be challenging for employers to retain quality employees and find new talent.[2] That is why, employers need to offer a total rewards program that does both.

A total rewards program includes a competitive salary, benefits and developmental rewards. And if your employer clients are looking to retain and attract the best and the brightest, then they should know what employees value – a good 401(k) plan and its contribution towards an enjoyable and dignified retirement.

What Do Employees Want?

Research says that employees want a 401(k) and more importantly, they want employer matching contributions.[3] With nearly 3 out of 4 plans offering a matching formula and the most typical employer match of 50 cents on the dollar on the first 6% of pay, employees clearly want to benefit from a retirement savings plan with an employer match.[4]

In fact, 65% of workers said they could be motivated to leave their current job for one that offers a high-quality 401(k) or other retirement plan.[5] Financial benefits are now a top priority. Interestingly, they rank higher than in-office perks and vacation time.[6]

If your employer clients want to offer competitive compensation, then part of the conversation needs to include the importance of an employer match.

Matching and Vesting, a Delightful Combination

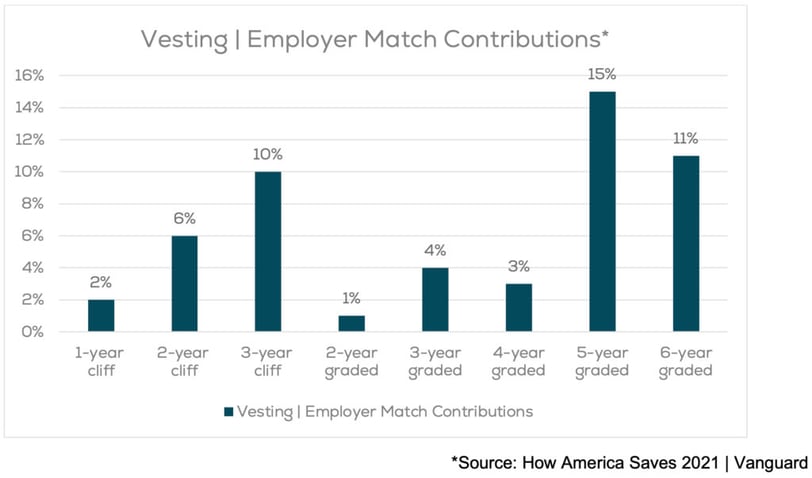

To help employers retain loyal employees, consider implementing a vesting schedule. Approximately 52% of plans use some type of vesting schedule, with the most popular options being a 5 year (15%), 6 year (11%) or 3 year (10%), respectively.[7]

By nudging employers to think differently about matching and vesting formulas, you can help them calm today’s inflation and employment worries because allocated funds will be invested for a longer period of time and only reward loyal employees.

As an advisor, the current environment presents an opportunity to talk with employers about the importance of competitive total rewards and the benefits of plan design flexibility.

On-demand 401(k) Flexibility

To help your clients view different plan design options in real time, check out FDI’s Retirement Outcomes Evaluator. Our interactive plan design tool will display up to 5 different plan design formulas in a convenient side-by-side format. The easy-to-read layout allows you to discuss scenarios with your employer clients that can ease cash flow worries, reward top employee talent and assist in recruiting new hires.

Winning the War for Talent

The job market is fiercely competitive, which puts pressure on employers. When the cost of replacing an employee is not only time and training, but also a 20% increase in salary, employers feel the pressure to raise total rewards to keep employees happy and ward off any poaching recruiters.

With nearly 90% of employees agreeing that employers should offer financial wellness programs, here are two workplace activities that can help employees reduce financial stress and feel confident in their retirement planning.[8]

- Offer a financial wellness program. With the average cost of financial stress reaching $2,412 per employee due to lost productivity and absenteeism, it is imperative that employers recognize the short- and long-term benefits of a financial wellness program.

- Allow employees to immediately save for retirement. Help employees start early and get ahead. At year-end 2020, 54% of plans had adopted automatic enrollment, including 74% of plans with at least 1,000 participants. If your employer clients have not considered automatic enrollment, now might be a great time for a conversation – especially with the $500 tax credit for the first three years provided by the SECURE Act.

When employees appreciate their total rewards package, everyone wins.

You Are More Than You Know

Being a retirement plan advisor is more than investment analysis, benchmarking and fiduciary partnership. It is also about understanding the challenges of your business owner clients, which include inflation and staffing concerns.

Yet, as an expert advisor, you can bring a solution that can solve for both worries – the 401(k) plan. By supporting your clients with appropriate plan design education, you can teach employers about different formulas that ease cash flow concerns (e.g., discretionary match) and rewards loyal employees (vesting).

Then, to help employees combat the effects of inflation, start with saving, investing and financial wellness resources. By educating employees about market cycles, inflation expectations and asset allocation strategies, you can calm investor fears and take on a long-term perspective.

Should You Raise Your Fees?

With the cost of everything going up, should your compensation go up too? It depends. When was the last time you benchmarked your fees compared to your services? If it’s been a few years, then now is a great time to evaluate your offering and make needed adjustments. Benchmarking helps you charge a reasonable price – and one that adjusts during rising inflationary times.

For information on benchmarking, you know what to do. Contact us for a custom report, specific to you, your services and your retirement plan clients.

[1] “Table 2. Consumer Price Index for All Urban Consumers (CPI-U): U. S. city average, by detailed expenditure category.” U.S. Bureau of Labor Statistics. January 2022.

[2] “The Employment Situation – December 2021.” BLS. January 2022.

[3] “The Impact of The Great Resignation on Benefits Needs and Expectations.” Betterment. January 2022.

[4] “How America Saves 2021.” Vanguard.

[5] “The Impact of The Great Resignation on Benefits Needs and Expectations.” Betterment. January 2022.

[6] “The Impact of The Great Resignation on Benefits Needs and Expectations.” Betterment. January 2022.

[7] “How America Saves 2021.” Vanguard.

[8] “Stress, finances and well-being.” John Hancock. January 2022.

About Author:

Craig Rosenthal, Head of Strategy and Chief Marketing Officer

Craig is Head of Strategy and Chief Marketing Officer for Fiduciary Decisions. In this role, he is responsible for driving Product and Partnership strategy as well as the overall messaging and marketing for the firm.