In response to companies wanting better protections against ERISA liability risk, Fiduciary Decisions (FDI) has collaborated with Encore Fiduciary and Fi360 to now offer plan sponsors a first-of-a-kind Triple Advantage Fiduciary Protection package with combined, cost-effective services and additional pricing consideration given for annual subscriptions.

This newly introduced package includes:

1. An industry-leading benchmarking report to show fee reasonableness determination

2. A complimentary fiduciary liability insurance review and discounted fiduciary liability insurance coverage

3. Fiduciary training for committee members

Offered by three retirement industry leaders with the intent to provide risk mitigation to plan sponsors if ERISA litigation occurs.

Because Director and Officer insurance typically excludes ERISA liability risk, companies are seeking both proactive and reactive ways to protect themselves that this package addresses.

ERISA Liability Risk is on the Rise

Plans of all sizes may be vulnerable

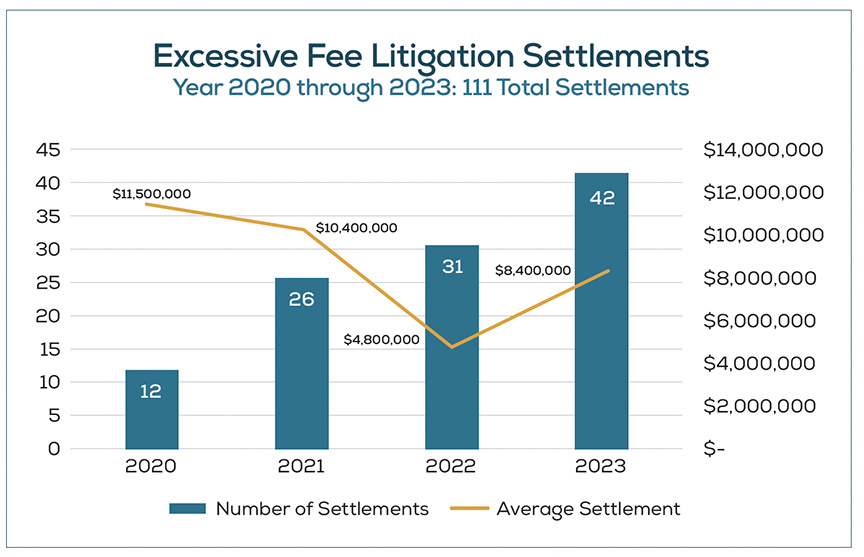

Under ERISA, your employee retirement plan carries fiduciary responsibilities that can expose plan sponsors and company officers to multi-million-dollar lawsuit settlements. (see CHART)

Common claims include excessive fees, deficient investment performance, and improper fund selection. And the damage can go deeper, affecting the company’s brand and reputation, as well as recruitment and client acquisition efforts.

Assessing your plan and managing risk is critical for protection.

>> In 2023, the average

settlement was $8.4 million. <<

Your Solution

A Three-Part Approach that Mitigates Plan Litigation and DOL Audit Risk

Offering Companies:

FDI is the industry's gold-standard for benchmarking, providing actionable decision support systems to the retirement industry.

WHAT YOU WILL GET

Best practices indicate that plan sponsors should benchmark their retirement plans when switching providers, implementing new fees, or experiencing significant changes in assets or participants. Regardless of plan size, regular benchmarking ensures your plan maintains competitive services and fees, a critical component of fiduciary responsibility.

THIS OFFERING INCLUDES

✓ The FDI Value and Fee Benchmarking Report with FEEPOINT® Calculation

✓ FDI delivery of report to the committee and support for questions

✓ Follow-up FDI Memo highlighting specific details of the report and summarizing the committee review call

ADVANTAGES

FDI has a five-step patented* methodology assists fiduciaries in understanding their plans reasonableness and offers risk mitigation against DOL audit and litigation.

Encore Fiduciary offers market-leading fiduciary liability insurance and expertise.

WHAT YOU WILL GET

✓ A complimentary review of a plan sponsor’s fiduciary liability insurance policy, with recommendations to improve coverage.

✓ Encore Fiduciary will provide its fiduciary enhancement coverage for any plan that subscribes with Fiduciary Decision’s services. This includes enhanced fiduciary breach and plan administration coverage and expanded fiduciary penalties coverages.

✓ 10% discount on fiduciary premiums for any plan sponsor that conducts annual benchmarking with Fiduciary Decisions

✓ An additional 10% discount for any plan sponsor who successfully complete annual Fi360 Fiduciary Essentials for Defined Contribution Plan training.

ADVANTAGES

The Encore Fiduciary policy provides an excellent scope of coverage to protect the plan and individual fiduciaries from personal fiduciary liability. AM Best rating of A+.

Fi360, A Broadridge Company, has trained thousands of retirement industry professionals in fiduciary best practices, building confidence and ensuring compliance.

WHAT YOU WILL GET

✓ Broadridge Fi360 will provide one complimentary Fiduciary Essentials for Defined Contribution Plans (FEDC) online course to help a plan fiduciary committee member understand their important role as a fiduciary and how to carry out these fiduciary responsibilities.

✓ Additional committee members can participate in the training for just $399 (a 30% discount from the regular price of $599)

ADVANTAGES

Fi360's easy-to-use, online course helps fiduciaries gain the knowledge they need to protect their retirement plans and participants.

BEST PRACTICES NOTE

• For plans over $100 million, the industry best practice is to benchmark annually, which is more cost-effective and efficient than an RFP process.

• Plans below $100 million should benchmark their services and fees periodically—at least every three to five years.

BENEFITS FOR YOU AND YOUR PARTICIPANTS

• Fiduciary Decisions is the industry leader for benchmarking, which helps satisfy the fiduciary obligation to determine fee reasonableness

– Shows the relationship between the fees you are paying and the quality, service, value and extras you and your participants are receiving

– Provides plan design and outcomes data, which demonstrates that your plan is competitive with your peers

– Offers the FDI Value & Fee Report with FEEPOINT® Calculation, which when paired with committee meeting notes is part of a prudent process that will help mitigate plan litigation and DOL audit risk.

• Encore Fiduciary is the industry’s premier fiduciary liability company.

• Fi360, a Broadridge Company, has trained thousands of designees in fiduciary best practices through its various programs.

BUNDLES PRICING FOR THIS THREE-PART FIDUCIARY PROTECTION

Fiduciary Decisions, Encore Fiduciary and Fi360 have collaborated to offer the industry’s most comprehensive approach to addressing fiduciary risk.

Bundling reduces costs, and this comprehensive package provides fiduciaries with risk mitigation and a repeatable, documented process.

Discount available for annual subscription.

Fiduciary Decisions' Proprietary Database

We've worked with service providers to build the broadest, deepest, most accurate database in the industry.

375,000+ Plans, All Market Segments (53% of Plan Universe)

$71 Trillion in Plan Assets 160+ Recordkeepers 1000s of Advisors

About Us

Founded in 2008, Fiduciary Decisions is the industry leader for independent, comprehensive, and actionable decision support systems for the retirement industry. Grounded in unparalleled data, technology, and innovation, we work side-by-side with you to ensure the best possible retirement decisions for you and your clients. Fiduciary Decisions’ flagship product is the Value and Fee Benchmarking with FEEPOINT® calculation report, which is considered the gold standard for determining fee reasonableness for defined contribution plans.

At Fiduciary Decisions, our goal is to collaborate with and strengthen all constituents of the retirement industry, helping service providers and plan sponsors, as well as plan participants and investors make fact-based decisions for successful retirement outcomes.

Fi360 provides fiduciary education, training and technology, including the Accredited Investment Fiduciary® (AIF®) Designation, a leading fiduciary designation held by over 11,000 advisors. Fi360’s technology enables broker-dealers to automate compliance procedures and identify at-risk assets, and helps investment professionals document investment processes and evaluate products.

Encore (formerly Euclid) Fiduciary is a premier fiduciary liability insurance underwriting company. We protect America’s employee benefit plan sponsors based on our superior fiduciary expertise and experience. We are known as fiduciary liability thought leaders and advocates for America’s plan sponsors. Starting in 2011, Encore Fiduciary has grown into the choice of many of America’s most sophisticated and complex single-employer, multi-employer, and governmental employee benefit plans. Every Encore Fiduciary professional represents our distinctive brand of relentless dedication and expertise to protect America’s benefit plans.

Learn more: call 866-516-4909 or sales@fiduciarydecisions.com