Managed Account Benchmarking

With increased interest in adding managed account solutions, it is more critical than ever to ensure plan fiduciaries have an independent process to determine if the managed account fees are reasonable.

FDI's Managed Account Benchmarking Methodology

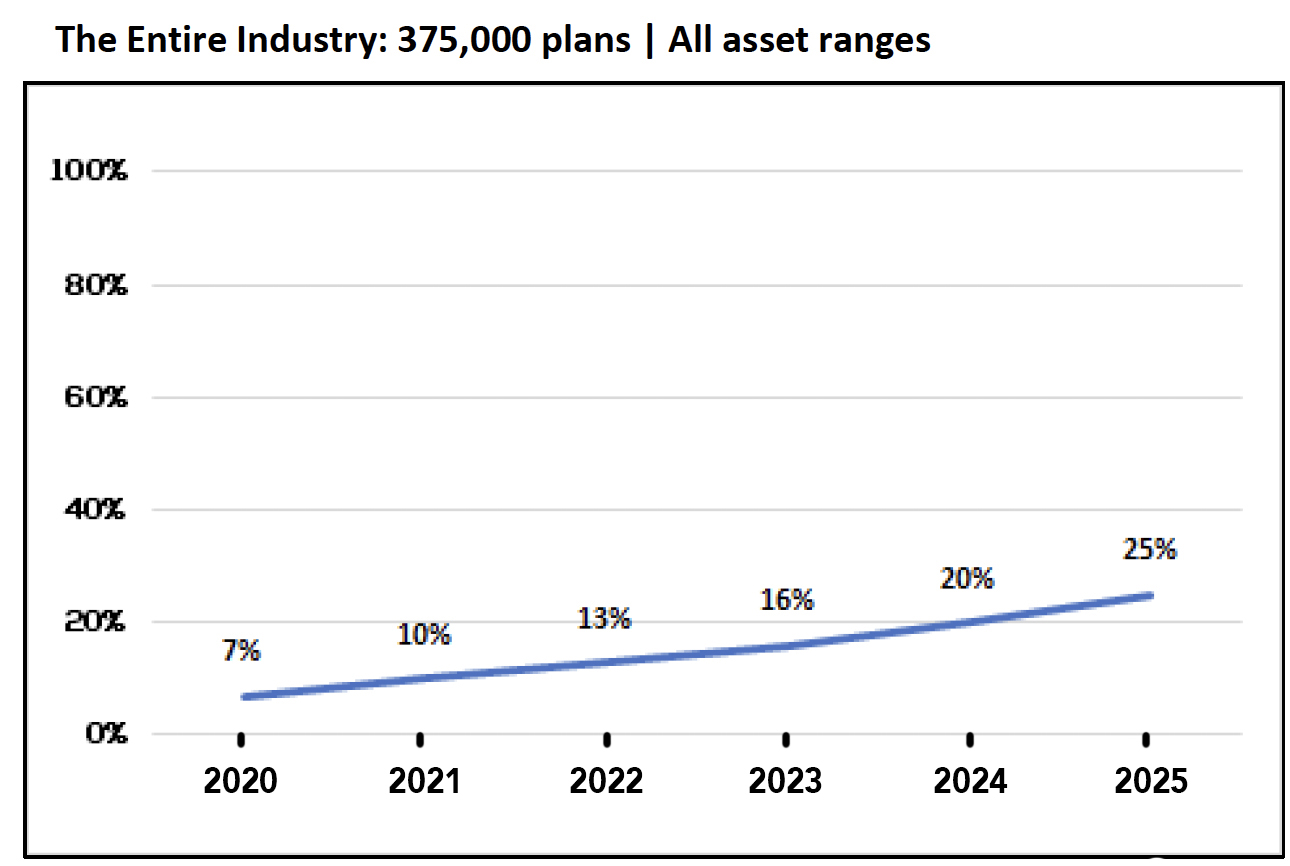

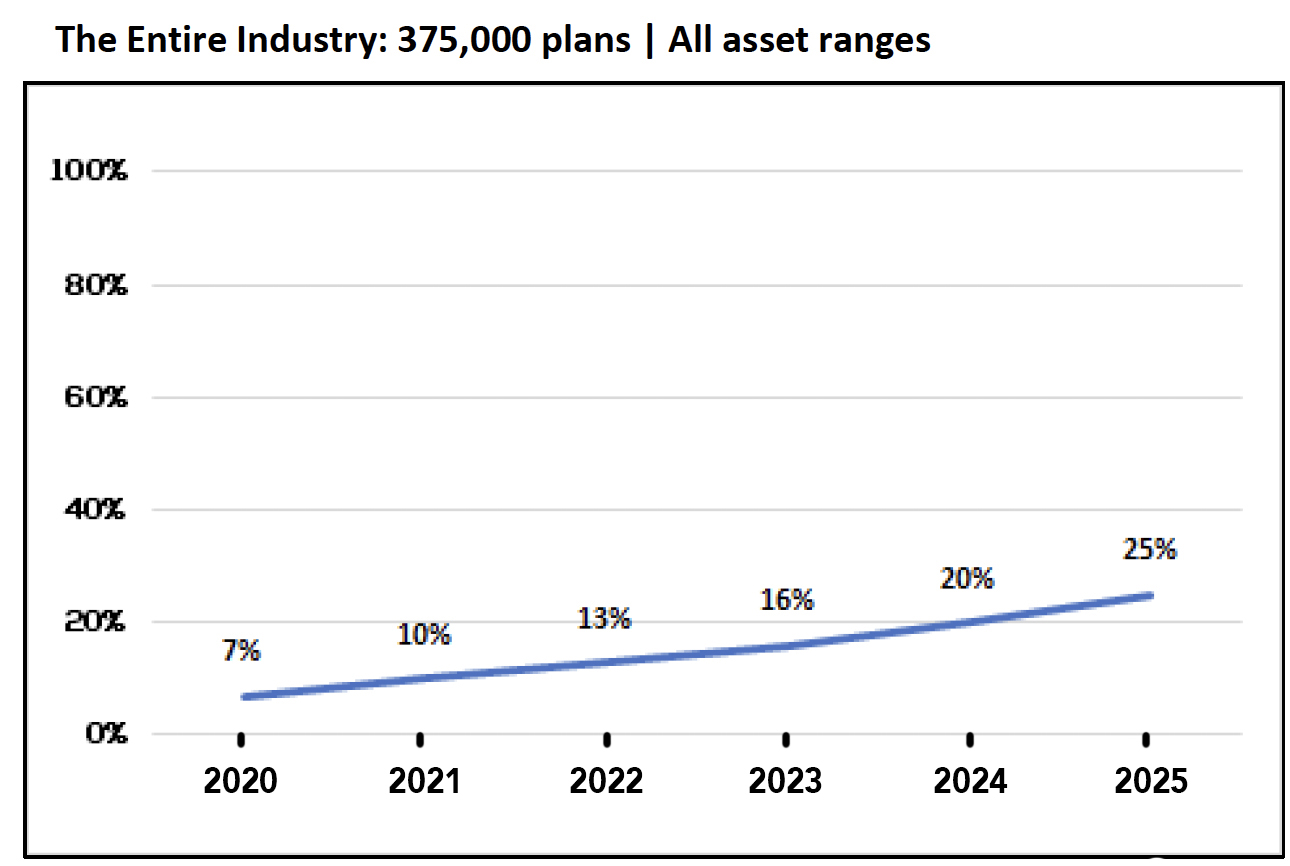

Broad Managed Account Benchmarking Data

Educate plan fiduciaries on types and usage of managed accounts across the industry.

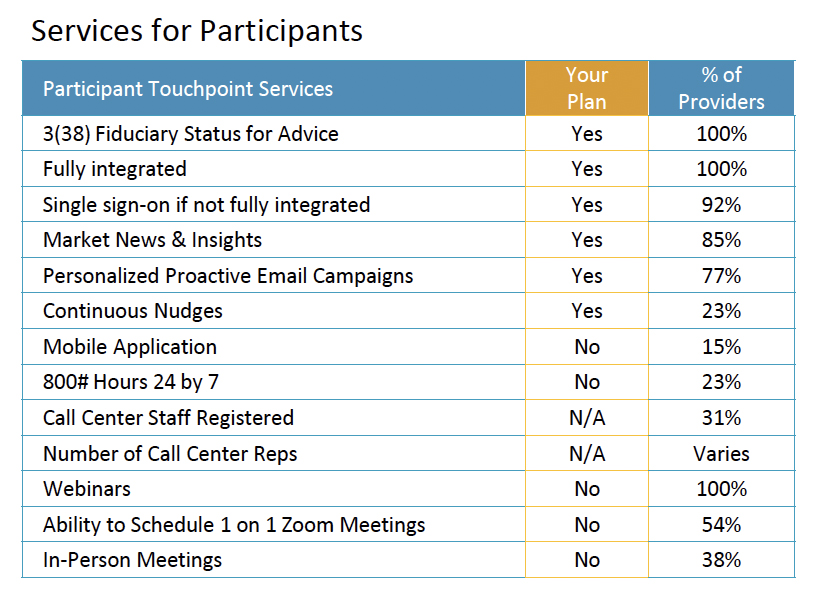

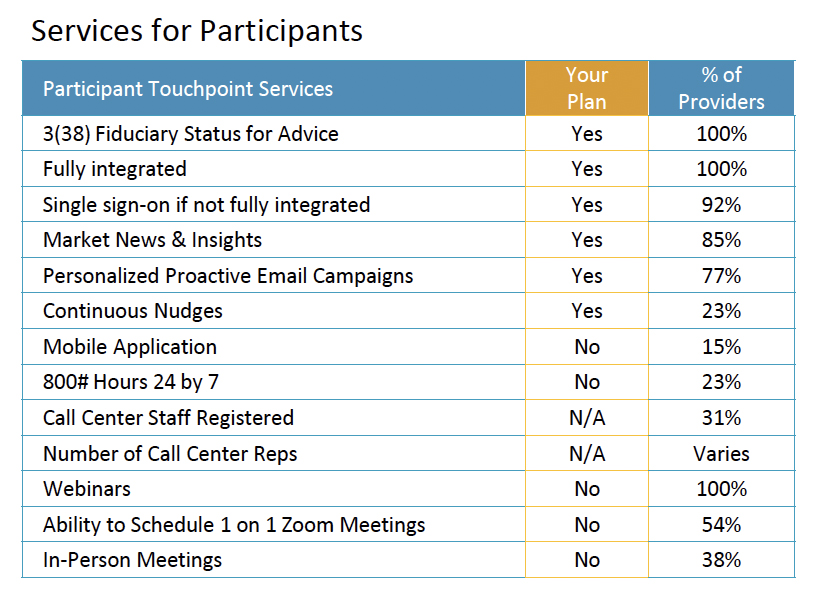

Assess Managed Account Services

It is important for fiduciaries to consider services for both= participants and plan sponsors.

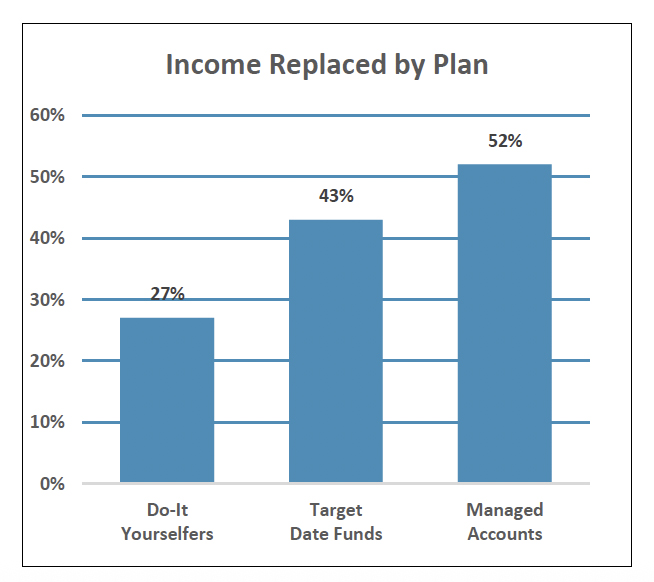

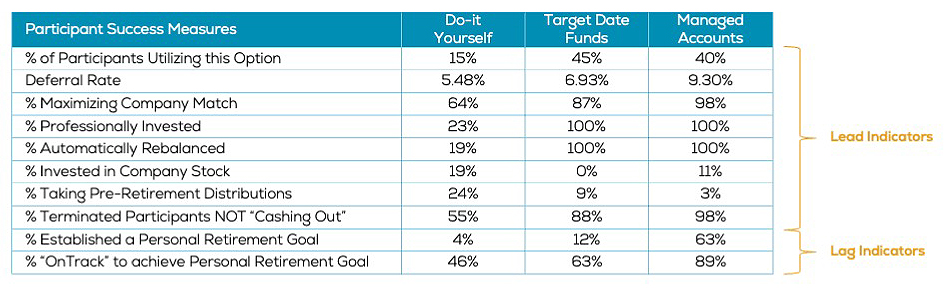

Comparing Three Investor Types

FDI solution assesses series of participant metrics across these three investor types;

- Do-It-Yourself (DIY)

- Target Date Funds

- Managed Accounts

Participant Metrics Measured by Investor Type

- Participant Success Metrics

- Income Replacement

- Engagement

- Performance

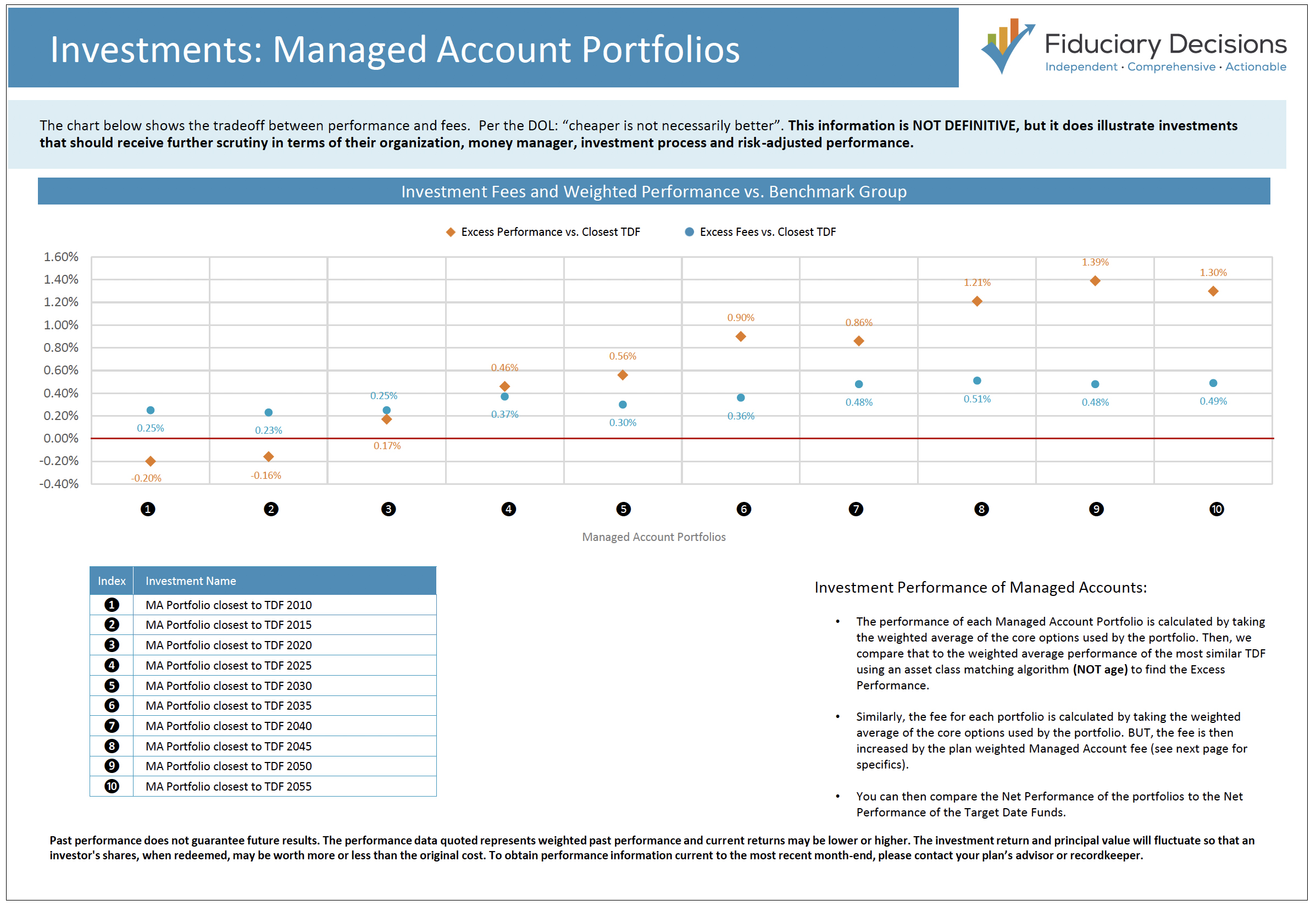

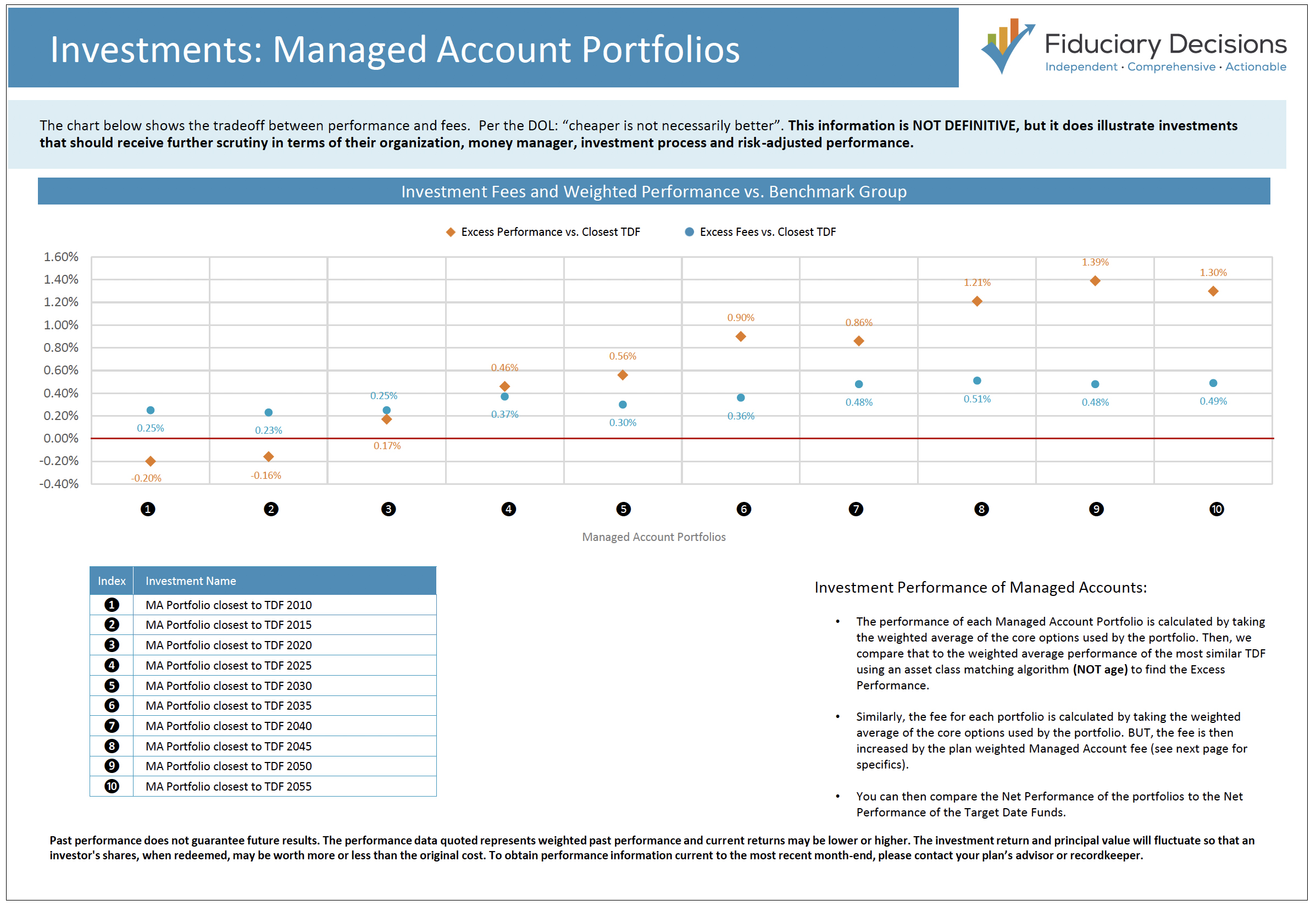

Fees and Performance

The final step for plan fiduciaries to consider is are the fees and performance of the managed account solution reasonable. In addition, the plans investment line-up is also benchmarked for performance and fees.