The Retirement Outcomes Evaluator (ROE) is a dynamic plan design analyzer that intelligently shows how different plan design alternatives can improve retirement outcomes.

The Choices We Make Determine Our Future

Historically, Plan Sponsors have had two ways to improve retirement outcomes: Education or Plan Design. While education has been a cornerstone of workplace retirement plans for years, Plan Design has had much more significant impact on improving participant’s saving and investing behavior.

However, the challenge in evaluating plan design alternatives has always been gathering data and performing time consuming analysis. Until now…

Win-Win-Win

The benefits of using ROE extend to three key parties associated with your retirement plan as follows:

.jpeg)

Participants

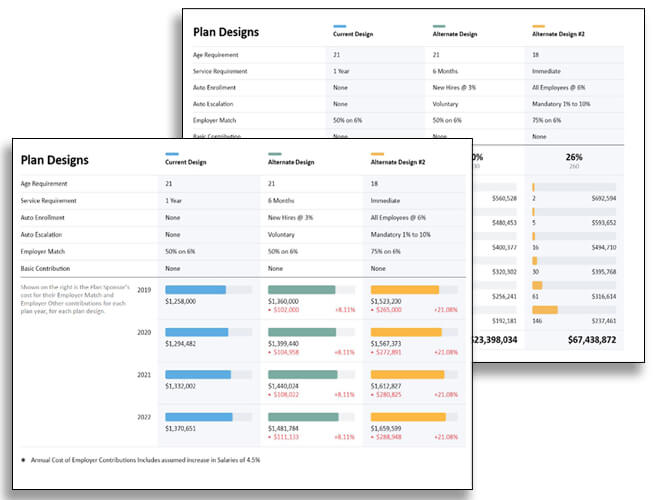

- Easily toggle between 11 plan design provisions that show how to improve participant saving, investing and spending habits

Plan Sponsors

- Quickly evaluate an unlimited number of plan design combinations

- Focus on improving outcomes, which has been cited by the courts in several lawsuits

- Help participants retire on time and how they want

Service Providers

- Access a powerful value-add service for Plan Sponsors in a manner that is consistent, comprehensive, scalable and efficient.

5 Steps to Improved Participant Behavior

Using a 5-step method, ROE can assist Plan Sponsors and Service Providers in identifying plan design alternatives that will drive better participant behavior and therefore outcomes:

.jpeg)

And there is so much more! Schedule a demo to see how FDI’s Retirement Outcomes Evaluator can drive participants to better outcomes.